Related Publications

Related Services

The Tax Cuts and Jobs Act (Pub. L. 115-97, referred to herein as the “Act”) provides new incentives for investing in certain low-income communities called “Opportunity Zones.” This briefing provides an overview of the new tools that facilitate Opportunity Zone investment and their potential impacts for economic and community development. For those with limited time, Balch has prepared a one-page summary of the new legislation and how it works – that summary is available here.

Under the Act, certain low-income Census tracts are eligible for designation as Opportunity Zones if they are eligible for the New Markets Tax Credit (“NMTC”) program under IRC 45D(e).1 However, not every NMTC-eligible Census tract will ultimately become an Opportunity Zone. The Act delegates responsibility to each state governor to identify 25% of NMTC-eligible Census tracts and submit the list of selected Census tracts in their respective states to the Secretary of the Treasury for certification. In addition, a special rule allows governors to designate a limited number of non-NMTC qualified Census tracts as Opportunity Zones under certain circumstances.2

The IRS recently provided detailed guidance on state selection procedures in Rev. Proc. 2018-16. However, neither the Act nor the IRS guidance imposes any substantive restrictions on how states must select the 25% of eligible Census tracts as Opportunity Zones. In other words, states may select Opportunity Zones based on anything from basic descriptive data (like population growth or income levels) to asset location (like proximity to hospitals, research universities or infrastructure).

This process must be complete by March 21, 2018 – however, the Act allows governors to seek at least one thirty-day extension period if their nominations are not complete by the deadline. Once designated, Opportunity Zones will remain in place for a 10-year period.

Tax benefits provided in Opportunity Zones revolve around capital gains. Industry estimates suggest that $2 trillion in unrealized capital gains remain on the balance sheets of individuals and corporations nationwide.3 Opportunity Zones provide a vehicle to re-invest those capital gains in a tax-advantaged manner – all while benefitting communities that have experienced chronic problems with access to capital.

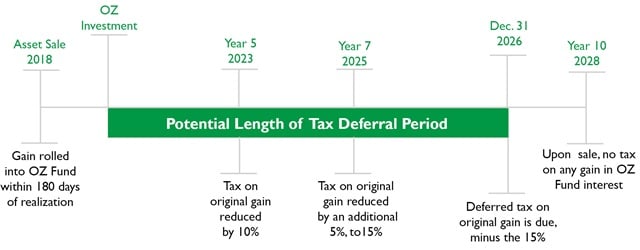

Once a corporation or an individual realizes capital gain from a transaction, that corporation or individual has 180 days from the date of sale to invest the gain in an “Opportunity Zone Fund” (described later in this briefing). Once the gain is invested in the OZ Fund, there are three primary tax benefits:

A timeline of benefits is provided below.

As drafted, the power of this new investment tool has no equal in the Code. For example:

We note that the Act does not limit the deferral election only to capital gains (although capital gains are mentioned as the basis for the incentive in the Committee Report accompanying the Act). As enacted, a taxpayer could defer any gain into an OZ Fund, and enjoy the same basis reduction if kept in the Fund for the required time periods. Also, there is no differentiation made in the Act between investing long-term and short-term capital gains in OZ Funds. As enacted, the Act could permit a taxpayer to convert short-term capital gains (taxed at ordinary income rates) into long-term capital gains (taxed at a preferential rate). While this is meaningless for entities taxed as corporations, it could be substantial for individuals or other pass-through entities (like LLCs, partnerships, or S-Corps).

The Treasury Department’s Opportunity Zone forthcoming regulations will likely provide some clarity on these and other points. Due to the Treasury Department’s formal administrative procedures to finalize the regulations, final implementation may not occur until late 2018.

Opportunity Zone Funds (or “OZ Funds”) are a new class of investment vehicles, organized as corporations or partnerships and holding at least 90% of their assets in Opportunity Zones. The Act allows OZ Funds to either hold interests (stock or partnership interests) in “Qualified Opportunity Zone Businesses” or to directly hold “Qualified Opportunity Zone Business Property” themselves.5 There are no statutory limitations on who can create or manage an OZ Fund, and we anticipate a wide variety of for-profit and not-for-profit fund managers.

A Qualified Opportunity Zone Business (“QOZB”) is a business in which “substantially all” of its tangible property:

The Act imposes additional restrictions on which businesses can qualify as QZOBs – chief among them being a requirement that QZOBS must derive at least 50% of total gross income from the active conduct of business in an Opportunity Zone. 7

By pooling capital through a fund structure and granting investors favorable tax treatment, OZ Funds serve to encourage large amounts of private investment, from across the country, to be channeled into rural and low-income communities while providing a favorable rate of return.

Other than the restrictions discussed above, there is no limitation on asset classes into which OZ Funds can make investments. As a result, we anticipate immediate OZ Fund activity in existing growth business sectors within low-income Census tracts, like commercial real estate. OZ Fund-controlled special-purpose entities can be involved in the development of new or existing commercial space through project and lease agreements with private developers using structures that ultimately provide better rates (and more investor security) than traditional loans. These structures can facilitate development of everything from new retail space to manufacturing to hospitals, community centers and even public assets. In the same vein, there is strong potential for using OZ Funds to finance revenue-producing infrastructure investments, whether through direct private ownership or through public-private partnerships. Twinning an OZ Fund investment with an additional tax incentive, like NMTCs, Historic Tax Credits or Low-Income Housing Tax Credits could create situations where developers can undertake major projects with little to no personal equity commitment.

Beyond project finance, there are potential venture capital and angel investor applications. One of the stated goals of the Act is to facilitate capital formation for active businesses in distressed Census tracts. When chosen carefully, Opportunity Zones could provide venture fund managers with a host of potential investment targets. Universities located in Opportunity Zones can take advantage of the designation to help capitalize startups commercializing their research and locate them nearby. Cities can create innovation districts located within opportunity zones to provide space for emerging growth companies – and provide the real estate and technology backbone necessary to serve such zones via the lease structures discussed above. Because the Act does not require QOZBs to spend down capital invested by OZ Funds within a certain amount of time, Opportunity Zones could become a more effective tool at providing working capital than NMTCs.

According to a Treasury statement released on February 7, 2018, the Department is planning to provide guidance regarding Opportunity Zones sometime before June 30, 2018. Final regulations will likely not be promulgated until late 2018 or early 2019. Until then, the actual mechanics of facilitating the investments described above will remain conceptual. However, unless the regulations substantially limit the broad potential drafted into the Act, OZ Funds are likely to emerge as the flexible tool of choice for investing in low-income communities designated as Opportunity Zones.

[1] Primary NMTC eligibility criteria are (a) the poverty rate within the tract is at least 20% or (b) the tract’s median family income does not exceed 80% of either statewide or metro area income (depending upon the tract’s location).

[2] For a tract to be so designated, (a) the tract must be contiguous to at least one selected Opportunity Zone, (b) the tract’s median family income cannot not exceed 125% of the neighboring Opportunity Zone tract, and (c) the total number of non-NMTC qualified tracts selected cannot not exceed 5% of the total number of Opportunity Zones selected statewide.

[3] Jim Tankerslsey, Tucked Into the Tax Bill, a Plan to Help Distressed America, New York Times (Jan. 29, 2018), available at https://www.nytimes.com/2018/01/29/business/tax-bill-economic-recovery-opportunity-zones.html.

[4] IRC 1400Z-2(b) provides that a taxpayer must pay tax on the gain equal to the difference between the lesser of the gain or the fair market value of the OZ Fund interest and a “basis” – which is initially set to zero and then stepped up to 10% of the gain in Year 5 and up to 15% of the gain in Year 7.

[5] “Qualified Opportunity Zone Business Property” is tangible property (i.e., machinery, equipment, etc.) held by an OZ Fund that (1) was acquired after 2017; (2) either (i) experienced its original use with the Fund or (ii) was “substantially improved” by the Fund; and (3) was used in an Opportunity Zone during “substantially all” of the Fund’s ownership of the property.

[6] IRC 1400Z-2(d)(2)(D) provides that property is “substantially improved” when the value of the improvements made to the property during the 30-month period after acquisition exceed the original basis of the property when it was acquired.

[7] Additional requirements include: (1) a substantial portion of the intangible property of the QZOB must be used in the active conduct of its business; (2) less than 5 percent of the average of the aggregate unadjusted bases of the QZOB’s property can be attributable to nonqualified financial property (like options, swaps, and futures contracts); and (3) the QZOB cannot be a private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store the principal business of which is the sale of alcoholic beverages for consumption off premises.